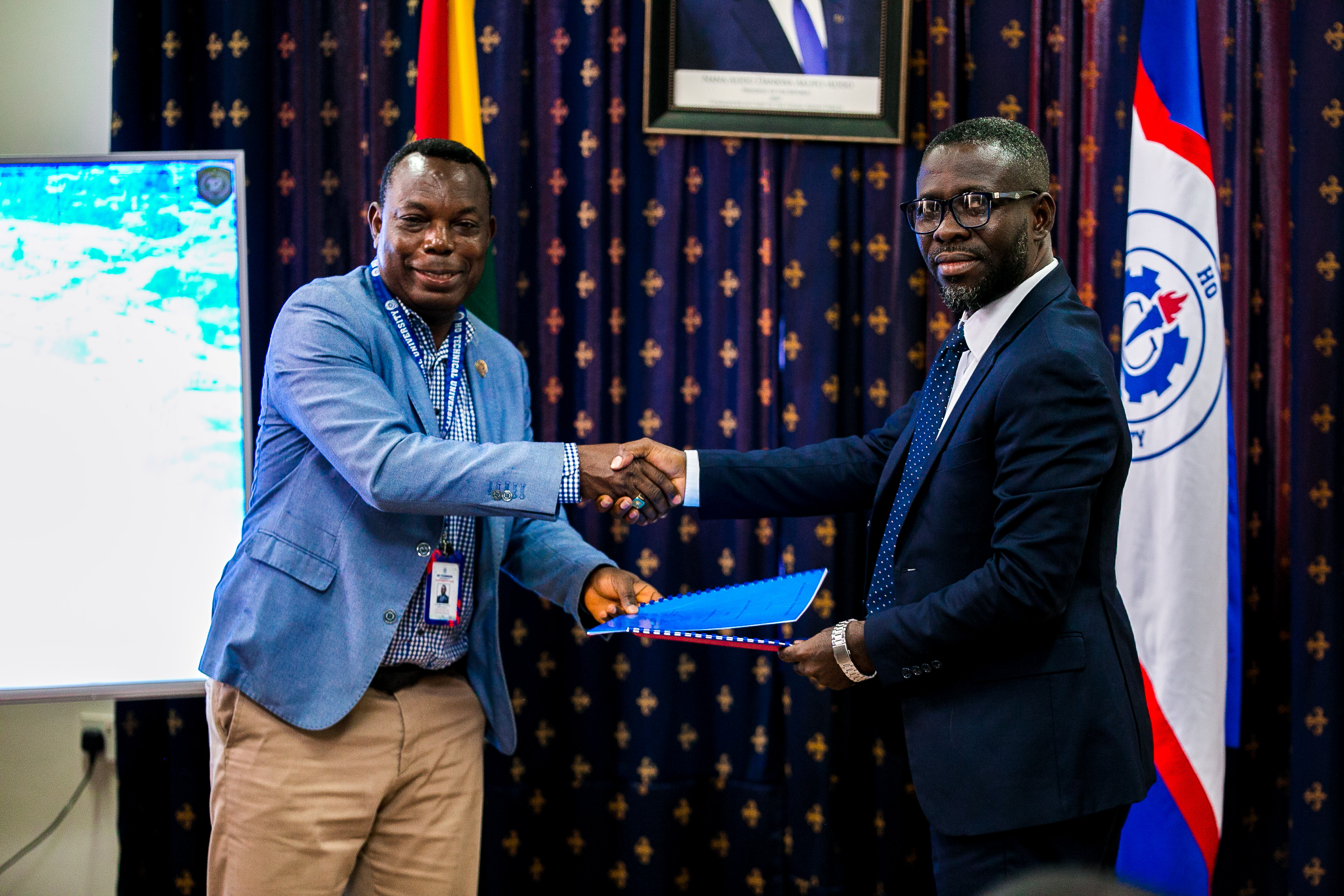

The University on Thursday, September 28, 2023 entered into a partnership with the indigenous financial technology company, Teksol Eganow Ltd, in furtherance of Academia-Industry collaborations, to enhance hands-on practical training of students.

A delegation from the company, comprising Mr. Senyo Kwami Fiati, Chief Operating Officer, and Mr. Emmanuel Forffoe, Human Resources Manager, signed the partnership agreement with Vice-Chancellor Prof. Ben Honyenuga and his Management team.

Mr. Fiati stated that, through this collaboration, the company would provide internship opportunities for students in the Computer Science Department of the University and also sponsor the Best Graduating Student Award in that department for the next three years. As a demonstration of their commitment to the partnership, the delegation donated a laptop computer to be presented to the best computer science student at the upcoming Congregation.

The Vice-Chancellor on his part, underscored the importance of industry partnerships in fulfilling the University’s mandate. He commended the fintech firm for initiating a mutually beneficial collaboration. He also noted that the award-winning Computer Science Department, under the Faculty of Applied Sciences and Technology (FAST), was a valuable asset, and this collaboration would further enhance its efforts in training highly skilled students for the rapidly evolving technology industry.

The VC also praised two University staff, Dr. Daniel Agbeko and Mr. Elolo Konglo, for their roles in facilitating the partnership.

Dr. John Coker Ayimah, Dean of FAST, expressed his delight about the partnership, highlighting that it would benefit both the department and the university as a whole.

About Teksol Eganow

Teksol Eganow Ltd is a financial technology company licensed by the Bank of Ghana as an Enhanced Payment Service Provider (EPSP) under the Payment Systems and Services Act, 2019 (ACT 987). Eganow is on a mission to democratise access to financial services across Africa and enable people to build healthy financial lives and participate in the digital economy, both now and in the future.